In marketing practice, we are called upon to determine customer insights so that our message can be directed toward the “right” audience, that it might resonate with that audience and persuade them to take action. Demographics play a large part in shaping that research, in tilting the questions in a way that will be easily digestible for the audience and give us the most insightful answers. Age is now the number one determinant of both duration and language skew for customer research we do for clients.

Millennials are the largest single generation in history, and are now of an age where they make up a significant percentage of all sorts of list factors – they’re now parents, breadwinners, purchasers with discretionary income, investors, and drivers of cars, purchasers of houses, and all the other things that the Baby Boomers used to dominate. But they are decidedly different in aggregate, and we have no choice but to acknowledge this in our work if we are to serve our corporate clients and provide them guidance.

One of the biggest general shifts the millennials have undertaken is their level of patience. Busy is the new normal, they’ve been over-scheduled by their parents for most of their lives, and they know no other way. As a result, time is more precious to them, and they are constantly pushing the envelope to find ways to do things faster, simpler, easier, more technologically assisted, more conveniently, to find some additional time to do what they want to do.

How does that impact marketing? In lots of ways. as it turns out. In their attention span, absorption of ad messages has to be even quicker than ever. The new calculation seems to be about 4 seconds, based on banner ad engagement times by Amazon.com and e-bay.com. That means messaging must be as straightforward, as direct, as obvious as can be, to transmit the full meaning and all its implications in the time it takes to glance at your Smartwatch.

In our daily work for clients, it impacts how many questions and what kind of questions we can include in any given research vehicle. Surveys have to be even more direct and shorter then ever before. According to research undertaken by Quirk’s Marketing Research Media,

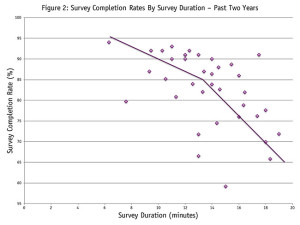

“Perhaps the level of patience for answering our surveys among the Millennial audience is deteriorating in the same manner as other mundane or routine tasks that we identified within our trend forecasting are being shunned. By isolating the past two years of research (Figure 2), a slightly different picture emerges.

Reviewing our most recent syndicated surveys shows that recent participation has been drop-ping off closer to the 13-minute mark, negatively impacting, on average, one out of every seven survey starts. By the time survey duration has reached the 20-minute mark, we’re looking at one in three participants deciding that we’ve overstayed our welcome and becoming intolerant of any more questions.

When faced with the reality that our survey participants are growing more impatient, we’ve resolved ourselves to advise our clients to aim for the 12-minute mark, anticipating that youth participants will surely become less patient over the coming year.”

Apparently, if you want to gather insights from this newly dominating demographic, the KISS rule applies in spades – simple, direct, accessible queries with no time wasted on niceties or the ever popular “rephrase to check for variance” is what’s going to get you there. And you banner ad creative types, take note – if you have to get your message across in 4 seconds, better sharpen your digital table stylus’ and buff up your copy editing skills – not so much for accuracy or grammar, which are also on the decline, but for brevity.

Clearly, knowing your target audiences’ demographics is even more important now than ever, and the lines between groups blurs and the number of subsets and subsectors of each group grows daily. Data is only as useful as the context in which it is interpreted, so keep in mind to whom you’re speaking when devising communications strategies aimed at this growing and powerful group of purchasers.